What is Form 1099-G

Federal, state, and local government entities issue Form 1099-G to notify taxpayers of funds received in the previous tax year. For example, Vermonters who received Unemployment Compensation in the previous tax year would receive a 1099-G from the Vermont Department of Labor showing the amount of unemployment income they received.

A 1099-G from the Vermont Department of Taxes shows the amount of your overpayment from last year’s Vermont income tax return. This overpayment is taxable in the current year if you itemized your deductions in the prior year. There is also a box on the form showing if interest was added to the refund. The interest is taxable.

Who receives a 1099-G from the Vermont Department of Taxes

The Vermont Department of Taxes issues 1099-Gs annually at the end of January to taxpayers who:

- itemized deductions on federal Form 1040 the prior tax year, and

- received a Vermont income tax refund from their Vermont tax return for that year

For example, a taxpayer itemized their deductions for tax year 2023. By itemizing, that taxpayer deducted their Vermont tax withheld from their 2023 federal return. If they withheld more money in 2023 than was needed to pay their Vermont taxes, they received a refund from the State. However, since that money was withheld pre-tax, and provided a tax benefit on the taxpayer’s itemized federal return, it is taxable income for the tax year the refund was issued.

This taxpayer would a receive a Form 1099-G from the Vermont Department of Taxes in January of 2025 showing the amount of the overpayment.

1099-Gs are mailed by January 31 to people who had qualifying Vermont overpayments and received an associated refund by paper check the previous year. The form is mailed to the taxpayer’s last known address. To update your mailing address with the Department, use Form IN-110, Change of Name and/or Address for Personal Income Tax and/or Renter Credit Claim. 1099-Gs are also available on myVTax by January 31 for taxpayers who filed online.

The Vermont Department of Taxes does not issue a Form 1099-G:

- if a taxpayer had a zero return (no overpayment, nothing due), or

- had tax due on their return.

How to find a 1099-G using myVTax

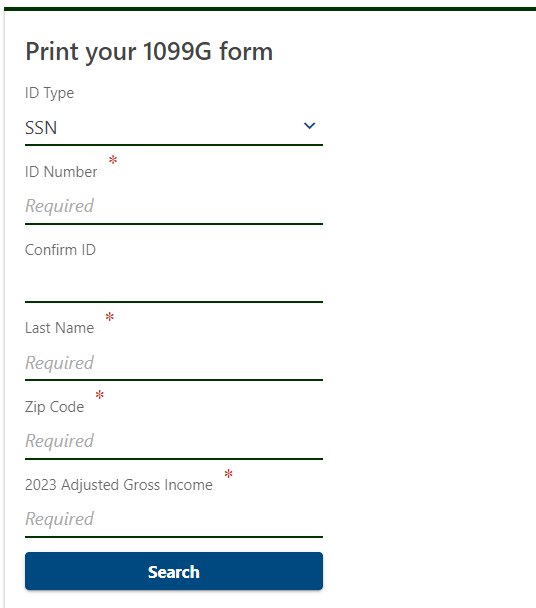

To access your 1099-G on myVTax in 2025 you will need this information from your 2023 Form IN-111:

- Your ZIP Code as shown on the form

- The Adjusted Gross Income amount (AGI) from Line 1.

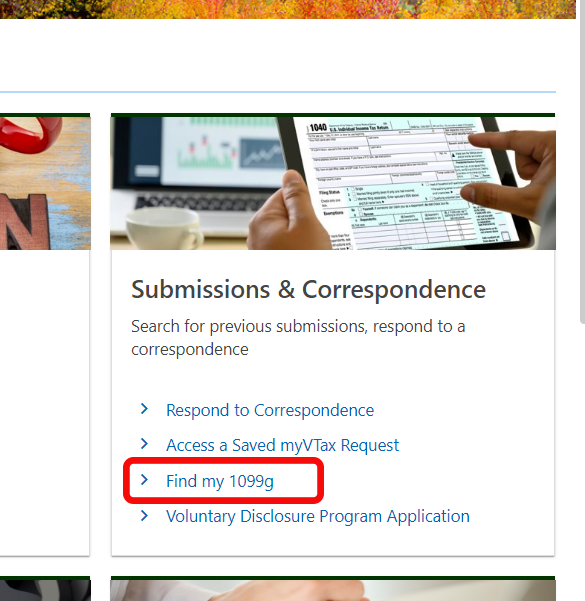

1. Go to myVTax.vermont.gov and select Find my 1099g on the home page.

2. Answer a few questions and select Search.

3. If there is a 1099-G for you, a second tab opens displaying the form. Print or save the form for your records. Do not attach it your 2024 Vermont return.

If there is no 1099-G for you, please review your 2023 federal return to verify you itemized your deductions on Schedule A. Review your Vermont return to verify the return showed an overpayment. If you still think there should be a 1099-G, double-check your entries and select Search again.

Frequently-Asked Questions

Do I need to report my 1099-G as income?

You don’t need to report your 1099-G as income if you didn’t itemize your deductions on Federal Schedule A for the tax year that generated the refund. If you took the Standard Deduction, you did not benefit from deducting State taxes, and therefore your refund is not taxable.

However, if you deducted your refund when you itemized on Federal Schedule A, it reduced your taxable income in the year you claimed it. If you later received a refund for an overpayment, then the refund is taxable because you were never taxed on that income.

Is interest on my refund taxable?

Interest is added to a refund if it is issued more than 45 days after the end of the April filing due date, (usually after June 1), more than 45 days after the return is received, or —if you filed an extension— more than 45 days after the extended due date, whichever of these dates is later. The interest is taxable income and should be reported on the return for the tax year following the refund, even if the refund itself is not taxable.

I have questions about a 1099-G that I received, but it was issued by a different government agency. Should I contact the Vermont Department of Taxes about it?

Form 1099-G is also issued by the Vermont Department of Labor to report Unemployment Compensation. If you have a question about an entry in Box 1 of the form, please contact the Department of Labor. The back of Form 1099-G, “Instructions for Recipient” explains the entries in each box. If you have questions about entries in any box other than Box 1, please contact the Department of Taxes.

What if my 1099-G shows more than my refund amount?

Form 1099-G shows the difference between your prior-year Vermont income tax and your credits, such as withholding and/or estimated payments. You may not have received the entire overpayment as a refund. This overpayment can take the form of refunds, offsets, or credits. A portion of your overpayment may have been used to:

- Pay Vermont Use Tax

- Pay tax due for prior years

- Pay bills from other State agencies

- Make voluntary charitable contributions on Form IN-111.

What if I should have received a 1099-G and didn’t?

If you feel you should have received Form 1099-G and did not, please review your prior-year Federal income tax return. If the return does not include Schedule A, you did not itemize your deductions, therefore your refund is not taxable. You will not receive Form 1099-G. If you still have questions, you may contact us.

What if I received a 1099-G from the Vermont Department of Taxes and should not have?

Contact us. Send an email to tax.IndividualIncome@vermont.gov or call 802-282-2865, or 800-282-2865 (toll-free in Vermont).

Email is not secure, so don’t include your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Send only your name, contact information, including daytime phone number, and a description of the issue. You may also send us a message. It’s important that you reach out to us as soon as you know there is a problem. We are here to help!