Our Mission

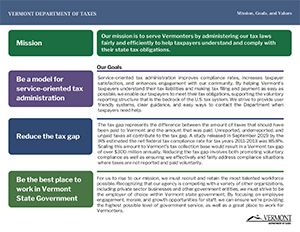

The mission of the Vermont Department of Taxes is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers understand and comply with their state tax obligations.

Our Core Values

Our core values guide us as we work to fulfil our mission and reach our goals. See the Vermont Department of Taxes Mission, Goals, and Values 2024 (pdf)

|

|

|

|

|

Service |

Integrity |

Growth |

Community |

Service

- We lean into problem solving.

- We are responsive to taxpayers, and we listen.

- We treat each taxpayer fairly.

- We provide reliable, clear communication and guidance.

- We promote voluntary compliance to reduce the tax gap.

Integrity

- We keep systems and confidential information secure.

- We set realistic expectations and follow through when we say we will do something.

- We collect the correct amount of tax.

- We hold ourselves accountable.

- We provide honest and accurate information.

Growth

- We work together to adapt to new challenges and continuously improve

- We provide a solid career path and communicate with staff to meet goals and recognize accomplishments.

- We provide educational opportunities to foster an environment that promotes professional and personal growth.

Community

- We work as one team across the Department.

- We encourage asking for and accepting help when needed.

- We treat all people with kindness.

- We value difference of thought, experience, and culture.

- We work across agencies towards common goals.