Guidance: How to Allocate Land Subject to Use Value Appraisal

Overview of the process

To assess land enrolled in the Current Use Program, begin by valuing an entire parcel at its fair market value as you would any other similar parcel in the municipality. If the entire parcel is enrolled, the fair market value is the grand list value. If only a portion of the parcel is enrolled, you have to allocate the value of the portion of the parcel that is not enrolled (the excluded land). You will find guidance on how to allocate the value of the excluded portion below. After calculating a value for the excluded land, the remaining value should be attributed to the enrolled portion. The total value of the excluded portion and the enrolled portion should always equal the fair market listed value of the entire parcel.

Please note: that the law has changed beginning with the 2016 tax year. The allocation described in this guidance is based on this law. 32 V.S.A. § 3756(d): “The assessing officials shall appraise qualifying agricultural and managed forestland and farm buildings at use value appraisal as defined in subdivision § 3752(12) of this title. If the land to be appraised is a portion of a parcel, any portion not receiving a use value appraisal shall be valued at its fair market value as a stand-alone parcel, and, for the purposes of the payment under section 3760 of this chapter, the entire parcel shall be valued at its fair market value as other similar parcels in the municipality.”

Where to Find the Current Use Data You Need

Your municipality will receive an electronic exchange file through your VTPIE grand list program from the Vermont Department of Taxes. The file will include the newly enrolled parcels in your municipality, the enrolled parcels that experienced a change in previous year, and the enrolled parcels that experienced no change. It will not include any pending changes to the parcels. Application information for all parcels is available in your land records and in the Electronic Current Use (eCuse) system. The eCuse system is a separate system from the file exchange, which is designed for clerks to electronically retrieve and submit recording information for current use data. Assessing officials can access eCuse to view and print approving and pending applications and research status of parcels.

In the spring of each year you will receive the electronic current use exchange that contains all approved information for current use properties. To find this information, log on to your VTPIE account and navigate to the Current Use module. This information is essential to identifying the land on the parcel that is excluded from current use enrollment.

Assessing officials must look at every parcel individually. The value for land excluded from current use is no longer a prorated value. The law now requires excluded land to be valued as a stand-alone parcel. This requires an understanding of the land schedule and the Computer Assisted Mass Appraisal (CAMA) system you are using. The Department encourages all assessing officials to attend trainings on current use and to consult with a district advisor to ensure that all excluded land is being valued correctly.

Processing the Download

Check for Differences Between the Grand List Information and the Current Use Information

For every individual parcel, first determine whether the total current use acreage for a parcel in section 9 matches the total grand list acreage. The current use acreage is based on the application information provided by the landowner. If there is a discrepancy, you should assume that the grand list is correct until you find out why there is a difference. There are several possible reasons for a mismatch, including the recent subdivision of the parcel, a purchase by the landowner of contiguous land, or a historic transfer that was previously unidentified. Research the reason for a discrepancy and report it through the current use exchange. To report your research, use the “Reasons for Change” checkboxes under “Acres” to code the error and then type specific comments in the “Town” comment field. Keep your research in case Current Use needs further documentation.

Next, determine whether the current use parcel number, ownership, and SPAN match the information on the grand list. The reasons for a mismatch may include: the order of the names listed on a property transfer tax return are different than the order given on the current use application; there was a recent transfer to a new owner; there was a transfer involving a life estate or trust; or there was a subdivision. Research the reason for a discrepancy and report it through the current use exchange. To report, use “Request Parcel Change”, choose “Other” and type specific notes in the “Town” comment field. Information needed for a transfer or subdivision: new owner, address, recording date, acres transferred, excluded or enrolled land transferred. Keep your research in case Current Use needs further documentation.

Remember that the current use maps are not a survey and should not be relied upon for acreage accuracy. If there is a difference in acreage for the parcel, you would prorate the enrolled acreage to make the total acreage match your grand list. The excluded acreage would remain the same. The only time you would adjust excluded acreage is if the property owner purchased an abutting property and the property owner has not revised the application to enroll that the portion.

Allocating Value to the Excluded Portion of a Parcel

Use the current use map for the parcel you are working on to determine the excluded land and any attributes that may factor into your valuation, such as topography, views, drainage, and access. Land attributes such as these will affect the grade multiplier that you will apply to the excluded portion of land. If you lack information related to the land attributes, you may need a site visit. Review the current use application for any description of the excluded portion.

For more guidance, see How to Value Land Excluded or Withdrawn from Current Use.

At this stage, please be sure to code and value only the excluded portion. Do not enter the total acreage of the parcel here as that would not be treating it as a stand-alone parcel with an independent value.

The following example assumes you are currently using the NEMRC Microsolve CAMA system. If you are using another CAMA system, you will need to develop a test parcel in that system to allocate values.

Example: A parcel has total excluded land of seven acres. You look at the map and see that two acres is a housesite and five acres is in a corner and is not touching the other two acres. You should value the two housesite acres using a building lot coded as 1/1 for two acres at the grade currently applied on the cost sheet. You should code the other five acres as 2/5 at an appropriate grade based on your knowledge and research of that portion of land. Account for all factors that affect the grade of that parcel of land.

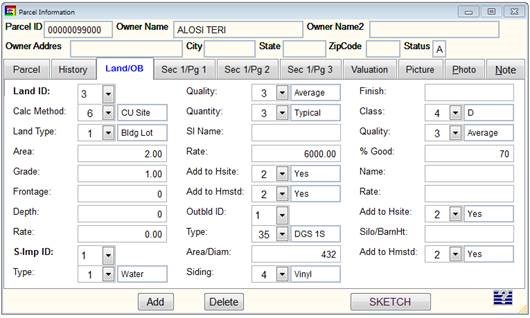

This image shows how you code a 1/1 for a two-acre housesite. This coding will treat the two acres as site value from the full land schedule or the site land schedule. This example shows a house site that was determined to be an average grade of 1.0.

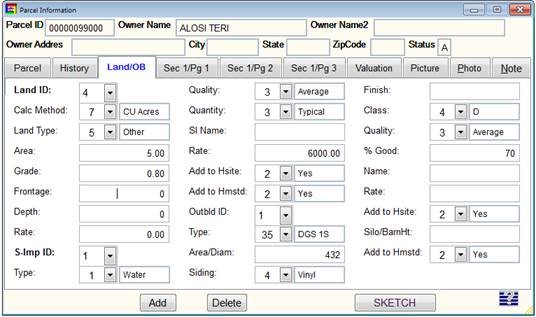

This image shows how you code 5 acres at 2/5. This coding will treat the land as five acres from the residual schedule. This example shows that this land was determined to be a 0.8 grade based on the physical attributes of the land.

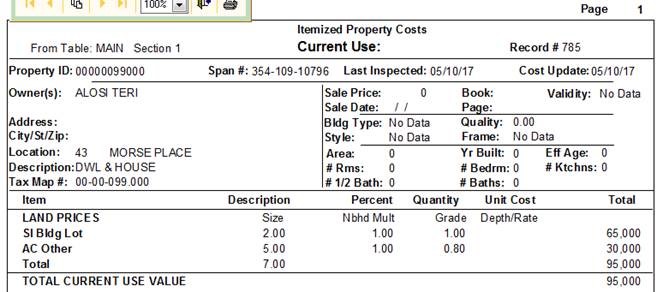

Using the land tab on the test parcel, code the excluded land as a stand-alone parcel that includes the total acreage of all excluded land (see example below). Be sure to note the configuration and location. You now have a value for the excluded land, which will be the excluded land value for current use allocation. You will be able to print a copy of this test parcel.

Next, run the cost and preview it. Consider whether the value makes sense for the amount of acreage based on what you know of the land. Consider whether this represents fair market value.

This image shows the preview screen after running the cost for a test parcel. This is an example only. Land schedules and land values differ from town to town. Do not expect these to be the values you see in your system.

Please Note: This is only an example and there may be situations where the allocation process will need to be adjusted. Every parcel must be considered separately, and the highest and best use as a stand-alone parcel must always be considered.

You are now ready to input the value allocation in the current use download edit screen. Enter the excluded land value as determined by your current use cost sheet first. Then, look at the total land value on your original cost sheet and subtract the value of the excluded land that you just entered. The remaining value is the value of enrolled land. Enter that value as the enrolled land value, which concludes the land allocation process.

Continue the value allocation for the remaining components of the parcel. This includes any houses, outbuildings, site improvements, and enrolled farm buildings. Hover the mouse pointer over the total value, which is located under “enrolled land.” In the upper right corner of the screen, there will be a grand list value for the parcel and the split between homestead and nonresidential. Check the appropriate tab (“Read Only Farm and Building Details”) and the current use application for information related to farm buildings. Enrolled farm buildings are always nonresidential, so be sure to code them as nonresidential in CAMA and re-cost if necessary. The total parcel value should not change and the allocated value should never exceed the total value of the parcel.

Input all remaining values until all the columns are green, signifying a match with your grand list. To complete the process, validate and save the parcel. Repeat this process for all parcels with land enrolled in current use.

Checking for Differences Between the Grand List and Current Use Records

Parcel Number/Ownership/SPAN — Current Use vs. Grand List

Verify whether the name and SPAN from the current use records match the grand list. If they do not match, try to find out why there is a difference. To report a transfer, split, deletion, or other change, use the drop down box labeled “Request Parcel Change”, and choose “Other” Add specific comments relating to your findings in the “New Town Comments” box.