Tax bills are generally mailed to property owners 30 days prior to the property tax due date. Contact your town to find out the tax due date. If the tax due date falls on a weekend or a holiday, taxes are generally due the following business day.

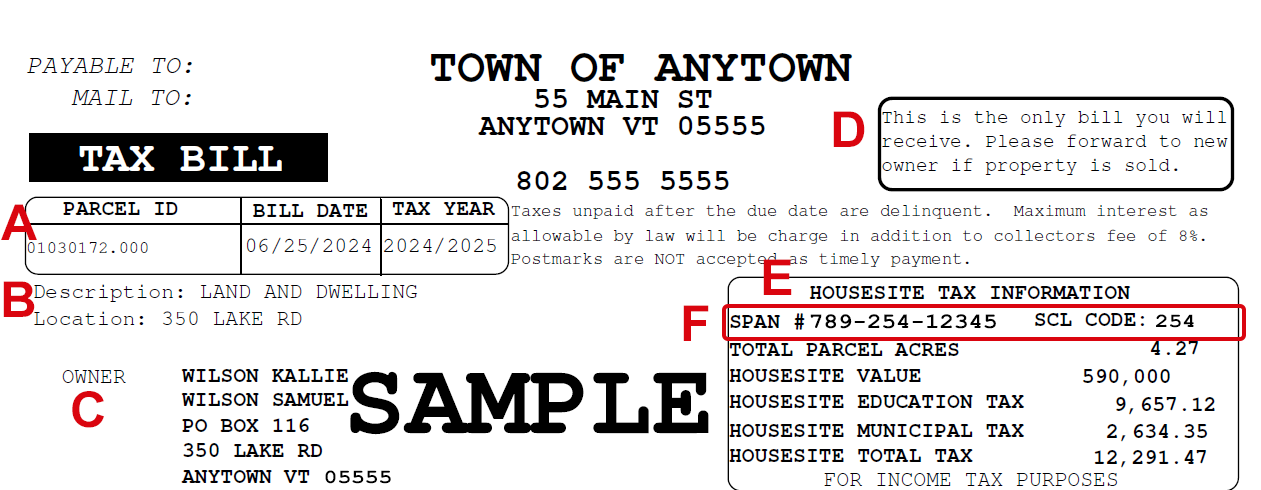

Here is an example of a typical Vermont property tax bill. The format varies for each town, so your bill may not look exactly like this sample. The Vermont Department of Taxes uses data and terms common to all property tax bills. Our intent is to show where requested information may be found.

Section 1

-

A town may use “Account Number” or “Parcel ID” to identify the billing account.

-

Property description, if shown

-

Current owner’s mailing address or owner by deed. Ownership should be current as of April 1. If not, notify the municipality.

-

Notice to forward the tax bill to the new owner(s) if the property is transferred after bill is received

-

The Housesite Tax Information box contents are used to calculate the state property tax credit payments, if applicable. The information is reportable on certain state tax forms, e.g. the IN-111 Income Tax Return; HS-122 Homestead Declaration; HI-144 Property Tax Credit Claim; LRC-140 Vermont Landlord Certificate and LRC-147, Lot Rent Certificate.

-

The 11-digit SPAN and the three-digit School Code are often requested on the above forms.

Property Tax Rates

-

Municipal Tax Rates: The municipal legislative body sets the tax rate or rates needed to raise money for municipal expenses. The municipal rate is levied against the municipal grand list.

-

Education Tax Rates: A homestead education tax rate and a nonhomestead education tax rate are set annually by the legislature. The education tax rates are levied against all homestead and nonhomestead parcels on the education grand list

Education Tax Rates

There are two education tax rates: homestead and nonhomestead. Bills may show one or both rates. If you filed a Homestead Declaration (Form HS-122) this year and have no business or rental use, your bill will show only the homestead education rate. If you filed the HS-122 Homestead Declarations and you have business and/or rental use, your bill should show both the homestead and nonhomestead rates based on the relative percentage of homestead and business or rental use.

If the property is not your primary residence, you cannot declare it as your homestead. Your bill will show only the nonhomestead rate.

Learn more about how the education tax rates are set.

Section 2

-

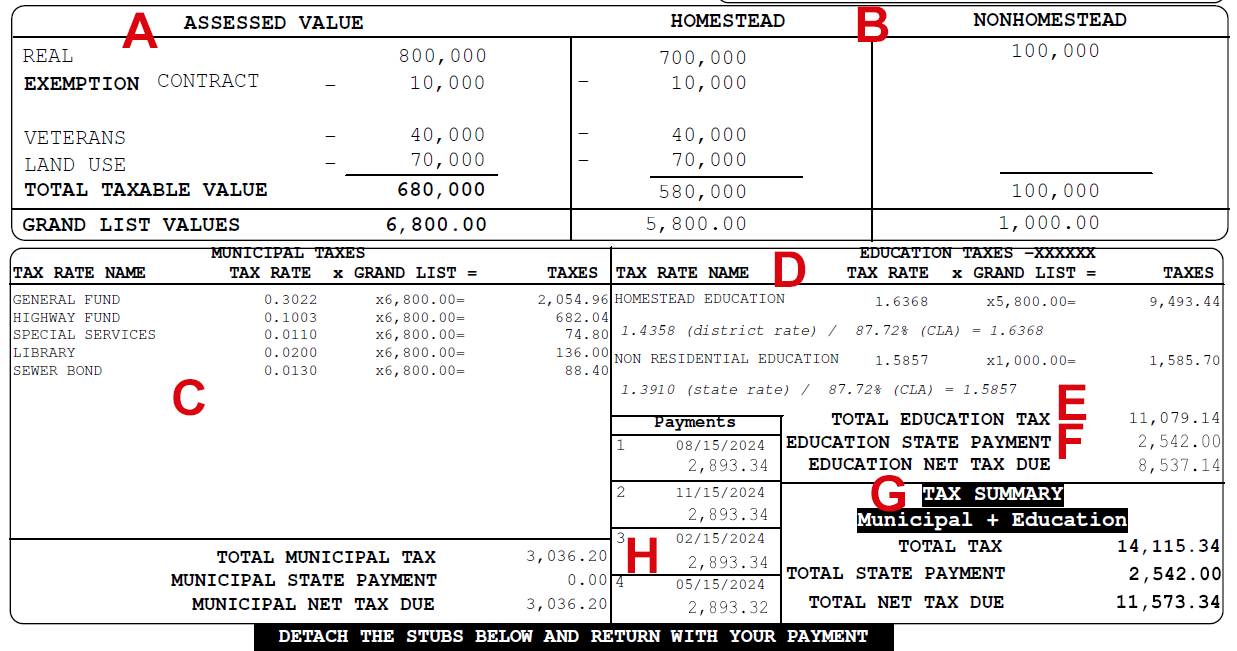

Total property value, as determined by local assessing officials. If you are entitled to a partial tax exemption of any kind, this deduction will appear here. See Notes on Exemptions, below.

-

Homestead and nonhomestead assessed values are portions of the full assessed value. If you filed a Homestead Declaration (Form HS-122) and you have business and/or rental use, your assessment will be split. Your business and/or rental use will show as nonhomestead.

-

Municipal tax rates are voted on at Town Meeting Day and controlled locally. These may include such special items as infrastructure bonds, allocations for a senior center or library, public services, etc.

-

Education tax information: homestead and/or nonhomestead tax rates for the statewide education property tax. View current year fiscal tax rates.

-

Your total Education Property Tax, before any property tax credit

-

The State payment is the Property Tax Credit. The State pays the credit, if any, directly to the municipality to reduce the amount of education tax owed for the homestead.

-

Your total property tax liability, summarizing any State payments and net tax due

-

Installment due dates and payment stubs (not shown) vary from town to town. Towns send out tax bills only once per year, but may have annual, semi-annual, or quarterly payment due dates

2024 Vermont Property Tax Bill Backer (pdf)

There is also a tax bill insert giving information on Vermont's income property tax credit and current use programs. The Department provides the text to your municipality. The information may be printed on the back of the tax bill or included as a separate insert.

Notes on Exemptions

Contract exemptions are for special circumstances where a municipality reduces the value on a portion of property being used for a public purpose, or where other exemptions exist by state law. Some municipalities also have community-specific stabilization agreements.

The Veterans Property Exemption is available if you meet the criteria, by applying to the Vermont Office of Veterans Affairs. There is also a Land Use Exemption, also known as Current Use. Learn more about the Current Use Program.