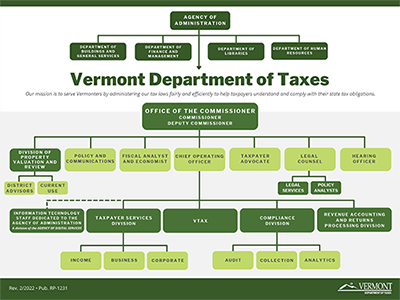

The Agency of Administration (AoA) provides administrative and support services to all Vermont state government agencies. The AoA includes the following departments:

- Buildings and General Services

- Department of Finance and Management

- Department of Human Resources

- Department of Libraries

- Vermont Department of Taxes

Divisions

Our Department consists of six divisions. These divisions work together to service the state as a department of AoA. The Tax Department primarily serves the AoA in collecting money to fund principal governmental functions.

The divisions that make up the Department include:

Office of the Commissioner

The Office of the Commissioner includes the Commissioner, Deputy Commissioner, and Chief Operating Officer and works with the legal team, consisting of the General Counsel, Hearing Officer, Taxpayer Advocate, and their immediate staff. The Office of the Commissioner responds to tax policy questions from the Governor, Legislature, and additional stakeholders. This division issues rulings, conducts tax appeal hearings, and represents the Department in civil and criminal litigation.

The Office of the Commissioner also includes outreach and education specialists, an economist, and a fiscal analyst to ensure that the Department adopts and supports thoroughly researched, well-reasoned, and transparent policy positions. Beyond analytical work, the division seeks to leverage the Department’s knowledge of the tax code while educating Vermont’s taxpayers so they are informed and compliant with the law. The Department accomplishes these goals by:

- Interpreting, evaluating, and formulating state tax policy

- Resolving tax policy questions

- Developing useful and current educational content

- Leveraging data to improve the experience of taxpayers

- Facilitating training events for both internal and external audiences, including taxpayers, tax preparers, legislators, and business owners.

The Office of the Commissioner is the expert entity regarding policy matters and stands as the voice for Vermont’s legislative beat. This division serves to answer your questions regarding policy changes and keep you and the state at large well-versed in legislative developments.

Compliance Division

The Compliance Division serves to supervise the appropriate payment of taxes throughout the state. Compliance works to reduce problems of delinquency and underpayment and to ensure that taxpayers are compliant with the law. The division fosters early intervention through educational assistance for all taxpayers. The Compliance Division consists of field and desk auditors, as well as collections staff. The field and desk auditors conduct tax examinations in the office or the field using various technology-based compliance initiatives. The collections staff contacts taxpayers with outstanding debts and works to administer the refund offset program for state agencies and the Internal Revenue Service (IRS).

Division of Property Valuation and Review

Property Valuation and Review (PVR) staff, which includes both in-office staff and traveling District Advisors, provide support to municipalities in developing and administrating property tax policies and related programs at the local level. PVR supports computer software programs used locally for grand list valuation and property tax administration. PVR has developed an educational training and certification program that is available to municipal listers and assessors. PVR conducts annual ratio (equalization) studies, which estimate taxable property values and grand list appraisals for school districts. In addition, PVR processes property valuation appeals in relation to municipal appraisals.

This division also administers the Use Value Appraisal Program (Current Use Program).

PVR staff work extensively with taxpayers, representatives, and towns in relation to these processes and programs.

Information Technology staff dedicated to the Agency Administration

The Information Technology staff (a division of the Agency of Digital Services) provides technological support to the entire Tax Department. This division oversees the systems that capture and process data collected from filed taxes and related returns, including providing IT security for all systems.

Revenue Accounting and Returns Processing Divisions

The Revenue Accounting and Processing Divisions oversee revenue accounting and returns processing for the entire Department of Taxes. The Processing division receives, sorts, scans, and posts all revenue and returns received by the Department. Scanned images of returns, bills, and correspondence are verified as readable and accurate. This group ensures legislative changes are reflected in tax returns and works with vendors to customize readable forms that are compliant with Department standards.

The Revenue Accounting Division processes incoming paper checks and electronic payments to the Department. This division ensures that daily bank deposits, refunds, transfers, and credit card payments are recorded and reconciled between bank and accounting systems. This group disburses funds collected on behalf of other agencies and municipalities and disseminates their respective money and supporting data.

Taxpayer Services Division

The Taxpayer Services Division is the public’s primary point of contact with the Department. The Division administers 31 tax types, several licensing programs, the property tax adjustment and renter rebate programs, as well as real estate transaction taxes, which include Real Estate Withholding, Property Transfer Tax & Lands Gains Tax. Taxpayer Services aids individuals, businesses, and corporations by responding to questions, resolving tax problems, distributing educational materials, and reviewing tax return information.

The examiners in the Taxpayer Services Division work to:

- Create a positive, open environment for communication with taxpayers, tax professionals, legislators, and town officials.

- Analyze legislative changes and implement policies and procedures to ensure the taxes are administered in compliance with the law.

- Compile tax forms and instructions, regulations, and general information about the taxes administered by the Department.

- Maintain and update the Department's online filing systems for individual and business taxpayers.

- Organize and participate in workshops for taxpayers, tax preparers, volunteer groups, and the general public

Taxpayer Services staff are available to answer your questions by telephone, email, letter, or in person. The call center accepts incoming phone calls on Monday, Tuesday, Thursday, and Friday from 7:45 a.m. to 4:30 p.m. We do not accept calls on Wednesdays to focus on processing and reviewing tax returns.

Review our statistical data, subject matter reports, and budget requests to learn more about the Vermont Department of Taxes.