The Current Use Program, also known as the Use Value Appraisal Program, allows the assessed value for a property to be reduced by a proportion of land and/or buildings enrolled in the program. Here is a sample Vermont municipal tax bill that shows a Current Use tax reduction. Find out if your property is eligible for this tax reduction.

How is the Land Use Value Calculated on an Enrolled Property?

A property’s applicable use value is calculated by multiplying the use value per acre of land enrolled (forest or agriculture) by the number of acres enrolled. The result is then multiplied by the Common Level of Appraisal (CLA) for your town and rounded to the nearest $100.

This example uses 2025 values where the CLA is 0.9208

| Acreage | Type | Use Value per Acre | Acreage x Use Value | (Acreage x Use Value) x CLA |

|---|---|---|---|---|

| 50 | Forestland | $203 | $10,150 | $9,346.12 |

| 10 | Forestland >1 mi. from Class 1, 2, or 3 road | $152 | $1,520 | $1,399.62 |

| 27 | Agricultural land | $510 | $13,770 | $12,769.42 |

TOTAL $20,091.86

Applicable Use Value (rounded) $20,100.00

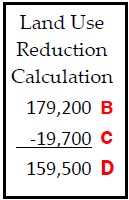

The Real Value (A) is the total value of the property and improvements before exemptions. Subtract the value of the land not enrolled in Current Use from the total land value to get the Enrolled Land Value (B). Then subtract the Use Value (C) from the Enrolled Land Value to get the Land Use Reduction (D). The Total Taxable Value (E) is the Real Value, minus the Land Use Reduction. Tax calculations are based on the Grand List Value (F), which is one percent of the Total Taxable Value. In the examples below, the municipal tax rate is 0.4, and the education tax rate is 1.4386.

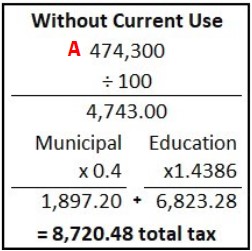

Example 1: Without Current Use

Without Current Use, property tax is calculated by dividing the Total Taxable Value of a property by 100 (or multiplying by 0.1), then multiplying the result of both the municipal and education tax rates.

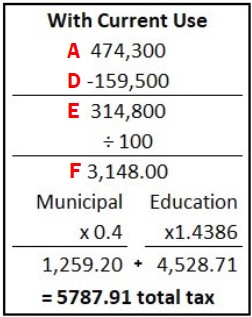

Example 2: With Current Use

With Current Use, the Land Use Reduction is subtracted from the Total Taxable Value first, allowing the property tax to be calculated on a lesser amount.

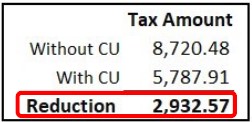

Tax Reduction with Current Use, based on Examples 1 and 2.

The tax reduction is the difference between the two totals above.

Please note: Current Use is affected by how a town values the excluded and enrolled land. Towns send an Allocation Notice to taxpayers when these values change. Review the notice to see how the new values change the tax bill.

Calculating the Taxes

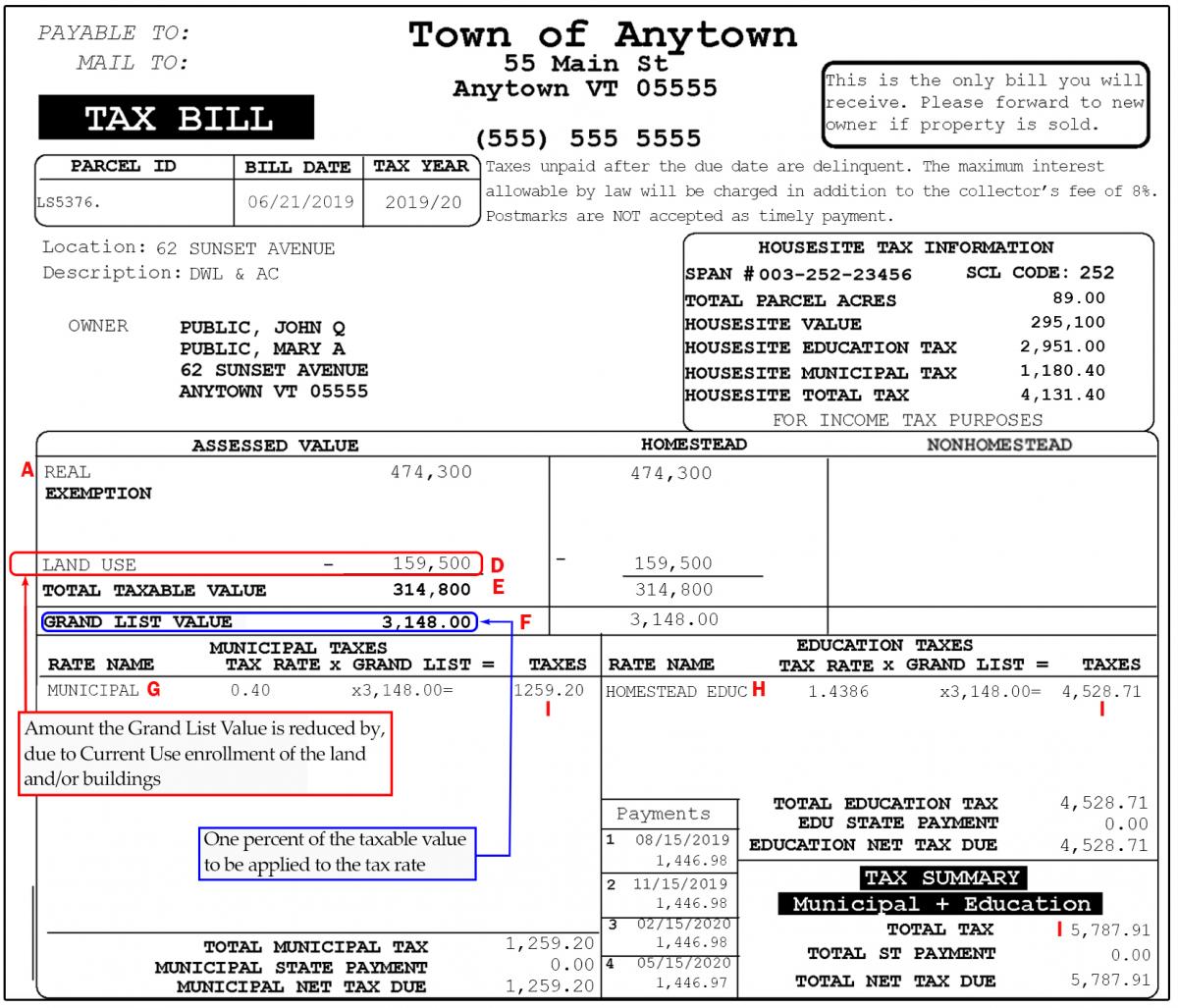

On a property tax bill, the Real (A) value is reduced by the Land Use Reduction (D) amount shown in the Assessed Value box to get the Total Taxable Value (E). The Grand List Value (F) is one percent of the Total Taxable Value and is multiplied by the Municipal Tax rate (G) and the Education Tax rate(H) to get the Taxes (I) due.

Sample Property Tax Bill

This is a typical Vermont property tax bill showing a reduction for Current Use. The bill format varies from town to town, so your bill may not look exactly like this sample, however the Department uses data and terms common to all property tax bills.

For a detailed explanation of the numbers and terms on a typical tax bill without current use, please see Understanding Your Property Tax Bill.