If you claim medical expenses on your federal individual income tax return, Vermont allows you a limited deduction for medical expenses on your Vermont income tax return.

The Vermont medical deduction became effective Jan. 1, 2019, beginning with tax year 2019. See 32 V.S.A. §5811(21)(C). The Vermont medical deduction is an amount equal to the itemized deduction for medical expenses on the federal return reduced by the following:

-

Vermont standard deduction

-

Vermont personal exemption(s) and

- Any amounts deducted federally attributed to an entrance fee or monthly payments to a continuing care retirement community that exceed the deductibility limits. The deductibility limits are shown in the table below. A continuing care retirement community (CCRC) is one regulated by 8 V.S.A. C. 151. There is currently only one such CCRC in the State of Vermont.

For these fees or payments, the deductibility for Vermont is limited by an amount equal to the federal deductibility limits for qualified long-term care insurance contracts under 26 U.S.C. 213(d)(10)(A).

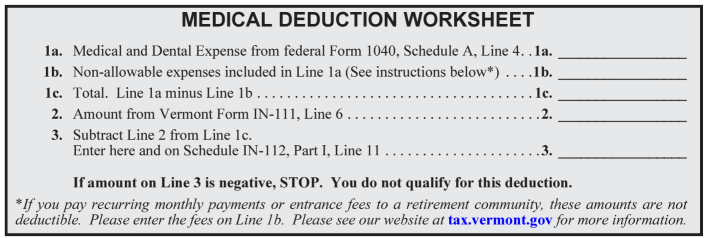

How to Calculate the Deduction

If you claim the medical deduction on federal Schedule A (Form 1040), Itemized Deductions, you are allowed to claim the Vermont medical deduction. Please see the medical deduction worksheet in the instructions for the Vermont IN-112.

1a. Begin with the amount you’ve calculated and entered for “Medical and Dental Expenses” on federal Schedule A.

1b. Subtract any amounts deducted federally that are attributed to payments of entrance fees or recurring monthly payments made to a continuing care retirement community that exceed the deductibility limits (see the table below) for premiums paid during the year for qualified long-term care insurance contracts.

Table: Deductibility Limits

For tax year 2024, continuing care retirement community fees or monthly payments deductible as a Vermont medical expense are limited to:

| Limitation on Premiums | Attained Age Before The Close of The Tax Year |

|---|---|

| $470 | Age 40 or less |

| $880 | Age 41 to 50 |

| $1,760 | Age 51 to 60 |

| $4,710 | Age 61 to 70 |

| $5,880 | Age 71 and over |

The 2024 limitations are from IRS Publication 502. These limits are published annually.

1c. Subtract line 1b from line 1a.

2. Enter the amount from the IN-111, line 6, which is the total of your Vermont Standard Deduction and Personal Exemptions.

3. Subtract line 2 from line 1c. If the amount is negative, Stop, you do not qualify for the deduction. If the amount is positive, enter it on the IN-112, Part 1, line 11.

Example 1

For tax year 2024, a married couple with no children itemizes their deductions on their federal income tax return and claims $50,000 in medical expenses. Their deductible amount for medical expenses for the Vermont income tax deduction will be $24,950.

Enter $24,950 on Vermont Form IN-112 on the line for the “Medical Expense Deduction.”

| Description | Amount |

|---|---|

| Federal deductible medical expenses | $50,000 |

| Subtract $14,850 (Vermont standard deduction) | -$14,850 |

| Subtract $10,200 (two Vermont personal exemptions) | -$10,200 |

| Deductible Vermont medical expenses equals | $24,950 |

Example 2

For tax year 2024, a married couple ages 65 and 66 (with no children) itemizes their deductions on their federal income tax return and claims $50,000 in medical expenses, $30,000 of which was for an entrance fee or monthly payments made to a continuing care retirement community. Their deductible amount for medical expenses for the Vermont income tax deduction will be $1,970.

Enter $1,970 on Vermont Form IN-112 on the line for the “Medical Expense Deduction.”

| Description | Amount |

|---|---|

| Federal deductible medical expenses | $50,000 |

| Subtract $17,250 (2024 Vermont standard deduction for two seniors) | -$17,250 |

| Subtract $10,200 (two Vermont personal exemptions) | -$10,200 |

|

Only $4,710 x 2 = $9,420 is allowed at the Vermont level for monthly payments or entrance fees to a CCRC so the overage needs to be subtracted. $30,000 - $9,420 = $20,580 |

-$20,580 |

| Deductible Vermont medical expenses equals | $1,970 |